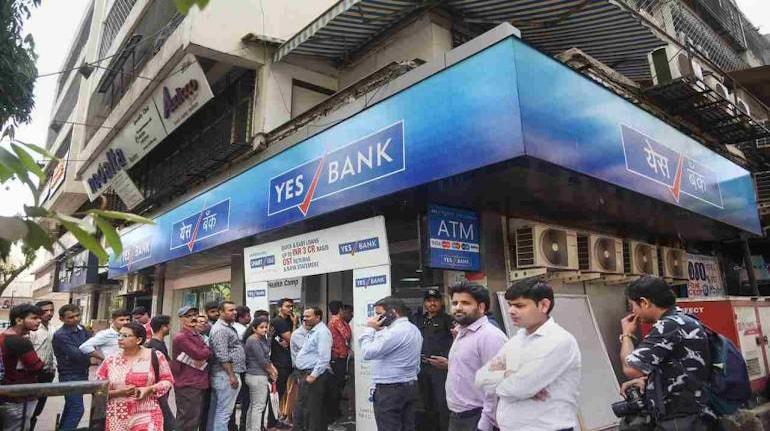

Yes Bank, India's sixth-largest private sector lender by assets, is looking for a new promoter. Livemint reports that the bank is planning to sell up to 51% of its stake for a target valuation of between $8-9 billion, which is a significant increase from its current market capitalisation of $7.2 billion. Citigroup's India unit has been enlisted to facilitate the search for a potential buyer.

Yes Bank has sent invitations to various Indian lenders, including current shareholders, to participate in this endeavour. The bank has initiated discussions with banks and financial institutions in Japan, West Asia, and Europe for the sale of at least 51% stake in Yes Bank. However, any new promoter holding more than 26% stake will need special approval from the Reserve Bank of India (RBI) as per central bank regulations.

The potential stake sale stands to provide an exit for major shareholders such as State Bank of India (SBI), Life Insurance Corp. Of India (LIC), HDFC Bank Ltd, and ICICI Bank Ltd, which had intervened to rescue Yes Bank in 2020 when it was facing collapse under its previous management.

Since SBI is the largest shareholder with a 29 percent stake, it has assured the appointed investment banker that the incoming promoter will obtain up to 51 percent ownership to ensure clarity in day-to-day management processes.

Yes Bank’s financial performance has demonstrated improvement post-ownership change, with a notable increase in its deposit base and a shift towards safer lending practices. However, perceptions regarding the quality of its loans remain a factor influencing the potential deal.

An ownership change could potentially reinvigorate Yes Bank, fostering competition among private lenders and offering better terms for borrowers. Overseas banks, particularly, find the deal enticing amidst projected growth in the Indian economy.

The timeline for the acquisition, targeted for fiscal year 2025, highlights the interest from global players. This strategic move follows RBI's intervention in March 2020, which saw SBI and other institutions stepping in to stabilize Yes Bank during a period of financial distress.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!