Personal loan disbursals to women borrowers have grown 26 percent between December 2022 and December 2023, according to a study released by credit information company, CRIF Highmark.

This segment registered the fastest growth during the said period when compared to other retail categories such as home loans, gold loans and auto loans (refer to graphic).

The total retail loan outstanding as far as women borrowers are concerned has risen by 19 percent, from Rs 26 lakh crore in December 2022 to Rs 30.95 lakh crore in December 2023.

Better access to credit for women boosting disbursals

The shift in women’s credit behaviour can be attributed to advancements such as digitisation which is leading to easy and quick access to formal credit, and credit scoring. There are several government-led initiatives aimed at increasing women's accessibility to loans.

“The Reserve Bank of India (RBI) has implemented certain regulatory reforms to encourage responsible lending and safeguard the interests of borrowers as it has made it mandatory for lenders to disclose the effective interest rate, processing fees, and other charges upfront to borrowers,” says Sanjeet Dawar, Managing Director at CRIF High Mark. Additionally, efforts by the government to increase financial and digital literacy are contributing to this development.

Also read | Women's Day: A college contest won this fund manager Rs 1 lakh cash prize and a career in mutual funds

“The top five factors for women taking a personal loan are medical emergency, followed by business expenses, higher education, household expenses and home decoration,” says Pramod Kathuria, Founder and CEO, Easiloan, fintech digital lender.

The rapid growth, however, is also a cause of concern, as these are unsecured loans that carry high interest rates of 15-25 percent, depending on the borrowers’ credit profile. Experts say that applying for a personal loan should be your last resort. If you are in a tight financial situation, first try and tap your emergency corpus if you have one. If you don’t, then liquidate your existing investments, including gold.

On their part, all individual borrowers, including women, should review their investment portfolio carefully before applying for loans. They should first look to arrange for funds by getting rid of dud traditional insurance policies, if any. Likewise, consistently underperforming mutual funds or stocks can be liquidated at a time when the stock market is scaling newer peaks. These steps could help create a sufficient liquid corpus that could eliminate the need to take personal loans.

Growth in gold, education and home loan segments

In the overall retail loan portfolio where women are the borrowers, gold loans accounted for 44 percent, followed by education loans (36 percent) and home loans (33 percent) (refer to graphic).

Further, the women are now pursuing their dreams by opting for higher education from India or abroad. So, there is a growth in the education loan segment as well.

The plethora of incentives for women home loan borrowers has led to a spurt in home loan disbursals. Home loan benefits for women include concessional stamp duty charges – lower by 1-2 percent – that many state governments offer, lower home loan interest rates and also tax benefits, though these are the same for both genders.

Also read | Personal loan or gold loan: Which is the winner if you need money urgently?

Close to 45 percent women borrowers are under 35

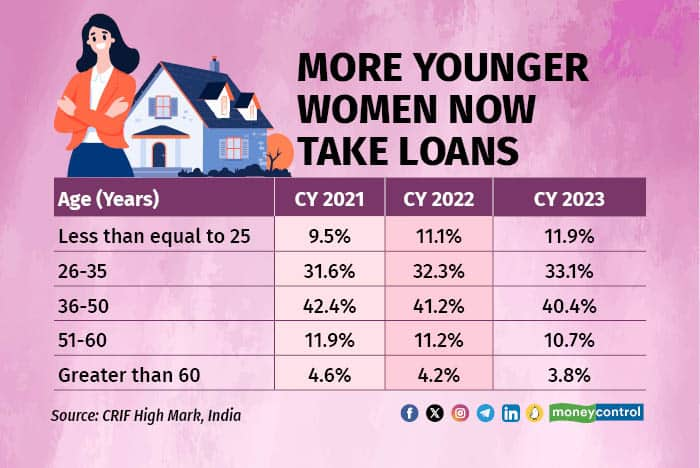

A large proportion of women borrowers are young as well. The share of young women borrowers under the age of 35 years (the two categories of less than or equal to 25 and 26 to 35) has continued to increase over the last three calendar years from 41.1 percent in calendar year 2021 to 45 percent in CY 2023 (refer to graphic).

The share of women borrowers in the age group of 36-50 years has declined from 42.4 percent in CY 2021 to 40.4 percent in CY 2023. Similarly, the share of women borrowers in the age group of over 50 years (the two categories of women between 51 and 60 plus women over 60 years of age) declined from 16.5 percent in CY 2021 to 14.5 percent in CY 2023.

New-to-credit women borrowers contributing to the growth

According to the CRIF report, the share of New-to-credit (NTC) originations volume – that is, loans sanctioned to first-time borrowers - among women borrowers is higher compared to male borrowers in CY 2023 for all major products except the gold loan (refer to graphic).

As per fintech lending trends report by FACE and Equifax, fintech lenders disbursed over Rs 7.1 crore loans worth Rs 92,267 crore in the financial year 2022-23. The key factor for the growth in disbursement of loans through digital lenders is the ease of applying for a loan digitally using smartphones, and outreach to NTC segments.

At Fibe, a digital lending platform for all women borrowers, NTC customers account for the largest share of borrowers at 32 percent. “However, there is responsible borrowing behaviour among women indicating that the age for availing a first loan has gone up over the last five years for NTC customers,” says Akshay Mehrotra, Co-founder and CEO, Fibe. The average age of women for taking a first loan has increased from 26 years in 2019 to 31 years in 2023, he adds.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Mergers are not a please-all solution

Mar 19, 2024 / 02:59 PM IST

In this edition of Moneycontrol Pro Panorama: IT stocks still a favourite despite earnings cut, learn to predict market price reve...

Read Now

Moneycontrol Pro Weekender: Saint Powell and the inflation dragon

Mar 9, 2024 / 10:03 AM IST

While the markets reach all time highs, the Bank for International Settlements warns that the last mile on disinflation is a diffi...

Read Now