Since the release of the GDP (Gross Domestic Product) estimates for third quarter (Q3) 2023-24 and for the entire year 2023-24, economists have been discussing the underlying trends of GDP growth. The data has led to posing more questions than giving answers. In an earlier article, I had discussed how the data shows wide divergence between growth rates of GDP and GVA. As both GDP and GVA approaches are used for computing a nation’s income, the difference in growth rates should at best be marginal.

In this article, we explore another odd finding from the GDP data: Wide divergence between growth rates of GDP and Consumption. We need to understand some basics before looking at the recent data.

In the earlier article, I had discussed how statistical authorities first calculate GVA and then compute GDP. The GVA approach is also called the Production approach. There is another approach to estimate GDP: Expenditure approach.

India’s Consumption And GDP Trajectories

Under the Expenditure approach, we estimate the expenditure incurred by the four major sectors of the economy: Households (consumption expenditure or C), Corporates (investment expenditure or I), Government (government expenditure or G) and External Sector (Spending on exports or X minus imports or M). On adding these different expenditures we get GDP (or Y). The expenditure approach is also the famous macroeconomic identity: Y = C + I + G + X – M.

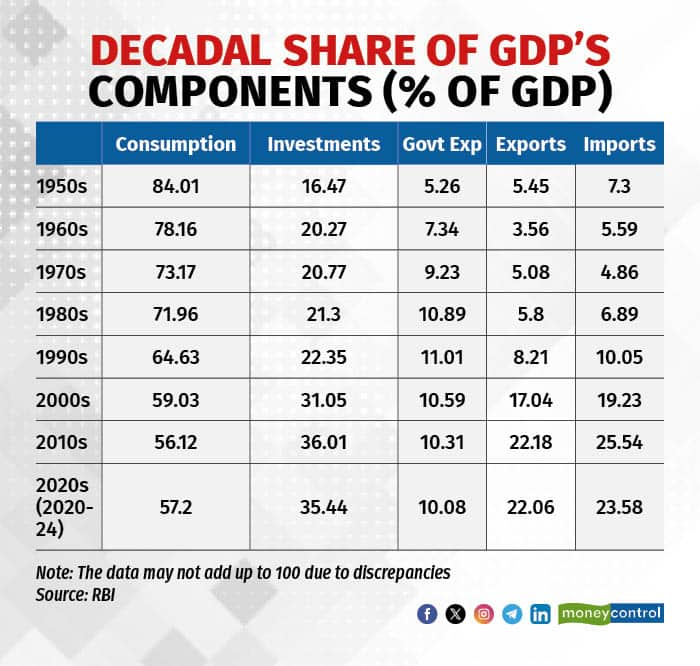

On analysing the Indian GDP data and the expenditure components, we see that India has been a consumption-oriented economy. The share of consumption in the economy in the 1950s was nearly 85 percent and has declined steadily to touch 57 percent in 2020s. The decline in consumption has been replaced by a rise in investments whose share has gone up from 16 percent to 35 percent in 2020s.

The share of government expenditure increased from 5 percent in 1950s to around 11 percent in 1980s and has remained around 10-11 percent in the subsequent three decades. The share of exports and imports has gone up four times mainly after 1991 reforms.

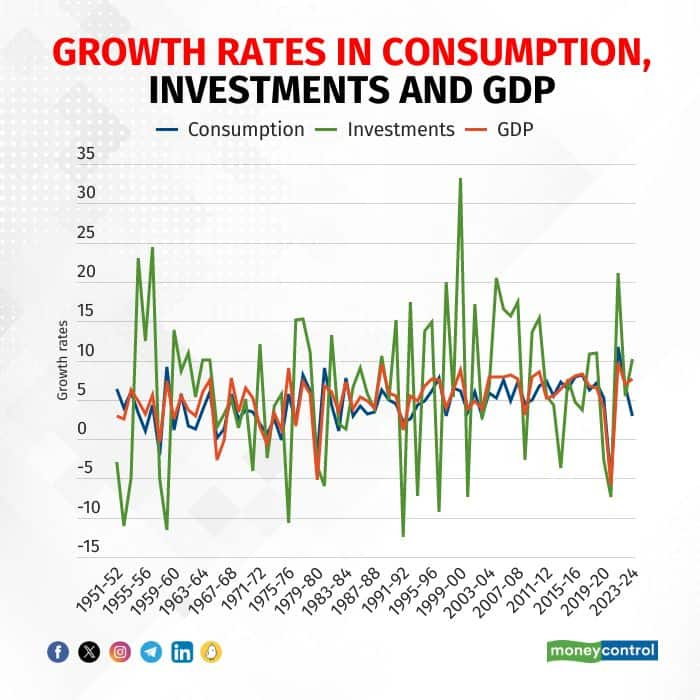

Despite the decline in share of consumption, it still contributes majorly to the GDP. Moreover, the growth rate of consumption has been similar to the growth rate of GDP for most part of India’s macro history. Whereas the growth rate in investments has been highly volatile.

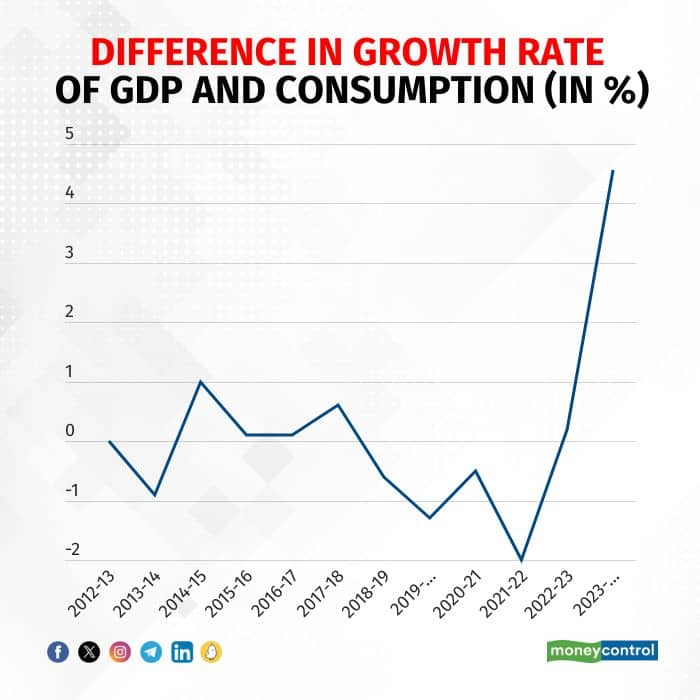

Given both the high share and stable growth rates, economists often say that consumption and GDP growth rates have a very strong correlation with a maximum difference of 0.5 to 1 percentage points. In particular from 2012-13 to 2022-23, we do see that the difference between GDP and consumption growth rates has been around 0 to 1 percentage points.

What Makes 2023-24 Different?

However, in 2023-24 we see that the difference between GDP and consumption has increased to 4.5 percentage points! The growth rate in GDP is pegged at 7.6 percent whereas growth rate in consumption is estimated at 3 percent. The difference between GDP and consumption is not just the highest since 2012-13 but in the entire GDP series available since 1951-52! The huge difference between GDP and consumption has led economists to question the data. The economists have said that either growth rates of consumption are higher or GDP growth is lower.

The difference between growth rates of GDP and consumption questions the growth rate of investments as well. Businesses look at growth rate in consumption data to make future investment plans. If growth rate in consumption is low, future investment growth is likely to be lower as well. Having said that, growth rate in investments in 2023-24 is expected to be 10 percent, higher than the 5.5 percent growth in 2022-23.

How is it that the growth rate in investments is high when the growth rate in consumption is low? The high growth in investments also does corroborate with what we generally read on investments in the media. There is this constant discussion in the media that private sector is not investing. So much so, the Finance Minister is constantly urging the private sector to invest in the economy.

Overall, the recently released GDP data has led to lots of questions and puzzles as the data is at odds with the earlier trend. In the earlier article, I had pointed out how GDP is higher than GVA by the largest margin in the data series.

In this article, I have discussed how consumption growth which has broadly mimicked GDP growth historically, is much lower than GDP growth. More importantly, the difference between GDP and consumption growth is the largest since 1951-52! The two puzzles show that while India’s headline GDP numbers appear impressive, there is more to the data that does not meet the eyes.

Amol Agrawal teaches at Ahmedabad University, and is the author of 'History of Private Banking in South Canara district (1906-69)’. Views are personal, and do not represent the stand of this publication.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!