Many small-caps took a punch in the face on March 13; A strong phrase to use but indices don’t really show what happened to individual stocks. That said, while large-caps weren’t hit so badly, the small-cap index fell by more than 5 percent in a day for the first time in about two years.

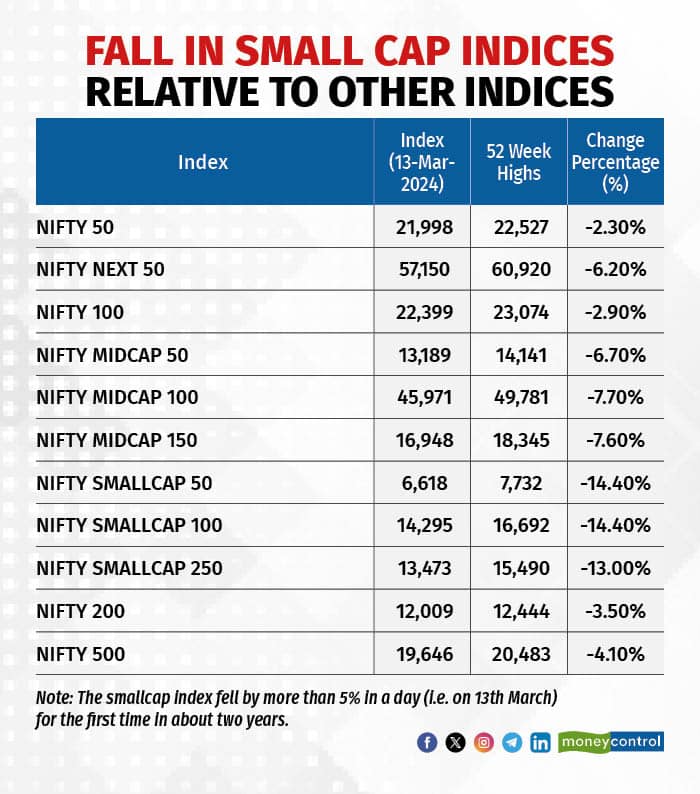

And if we zoom out a bit and look at the levels in comparison to the recently-made 52-week highs (image below), the pain in the small-cap segment is clearly visible:

To be fair, the rise in the small-cap segment in recent times was relentless and there were clear signs that too much froth was being built into the system. Even the regulator, SEBI, had clearly expressed its concern at the 'froth building up in the small and mid-cap segments of the market’ and prompting AMCs to stay cautious.

But is the fear that is clearly visible across (especially) mid and small-cap investors, a bit overdone?

Also read | MF stress test: India’s biggest small-cap fund can sell off its 50% portfolio in 27 days

While the popular small-cap indices have corrected 13-15 percent in a matter of weeks, there is still a lot of froth in the segment and valuations remain stretched. For now, the segment seems to be undergoing a healthy correction, which was much needed after the sharp run-up last year.

How much more will it fall? Or will it even fall or instead revert to it’s upward trajectory?

No one knows the answer to these questions. But if it does fall more, it will definitely bring some sanctity to small-cap segments and the irrationality that was spreading across.

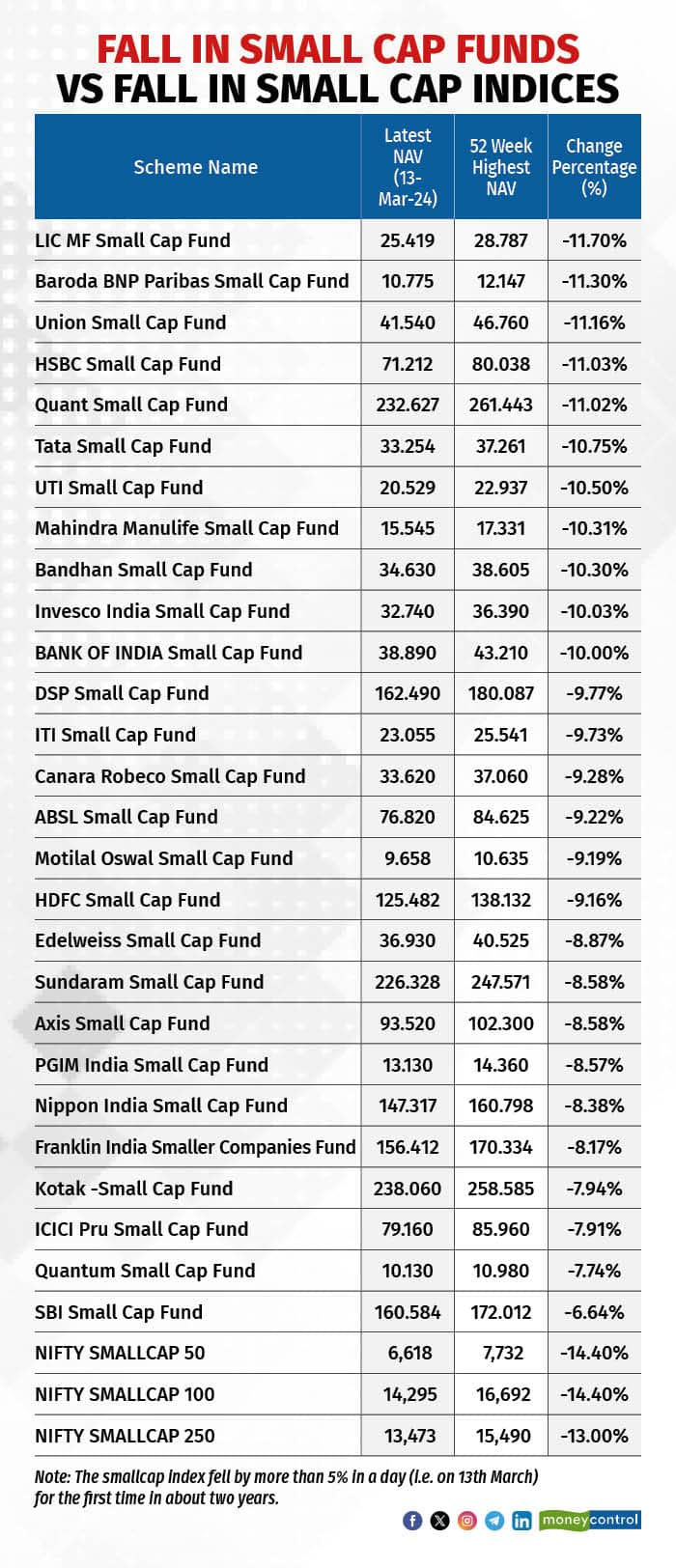

Small-cap funds, definitely offer the potential for significant future gains, but this comes at a cost of higher risks compared to large-caps. And in this fall, many of the small-cap funds have fallen comparatively less than small-cap indices as active small-cap funds have the flexibility to have some small allocations in large and mid-caps as well.

Have a look at the table below:

Now many of you may ask as to what is the right percentage to allocate to small-cap funds.

Different people have different opinions on how to build a portfolio and how much to allocate to different market segments. And just about a few weeks back, when the small-cap party was in full swing, many investors were tempted to invest heavily in small-cap funds.

But it is never easy being a small-cap investor. Highly volatile, not just at individual (smallcap) stocks level but also at the category level itself. It is not for the faint-hearted at all. And when things go wrong, they go wrong quite sharply and viciously.

One should only invest in small-cap funds if the risks are properly understood and one has the patience to stay invested for at least 5-7 years. And if you are coming to invest here after a really good period, then be willing to wait for even longer than 7+ years.

As I wrote in an earlier article about How much to allocate to Large, Mid and Small-caps, for an investor who identifies as a moderately aggressive investor, I would suggest capping the exposure to small caps to a maximum of 20-25 percent of the overall equity exposure. Nothing more unless you are really greedy and/or are willingly open to guaranteed higher risks for potentially non-guaranteed better returns.

And if you have SIPs running in small-cap funds and you are accumulating for the long term (10+ years) then you can let them continue. But do not forget to rebalance the existing portfolio’s allocation to small-caps . The best time to do that was a few weeks back, but, nevertheless, do it if the allocation to smallcaps in your portfolio is too high.

Also read | Will SEBI’s scrutiny hit hefty smallcap funds more? Quantum AMC’s Chirag Mehta answers

By limiting the exposure to riskier small-caps, and then regularly rebalancing when the allocation goes overboard, individual investors can manage their long term portfolios prudently even if the markets fluctuate wildly.

Disclaimer - The views expressed above should not be considered professional investment advice or advertisement or otherwise. No specific product/service recommendations have been made and the article itself, is for general educational purposes only. The readers are requested to take into consideration all the risk factors including their financial condition, suitability to risk-return profile and the like and take professional investment advice before investing.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Mergers are not a please-all solution

Mar 19, 2024 / 02:59 PM IST

In this edition of Moneycontrol Pro Panorama: IT stocks still a favourite despite earnings cut, learn to predict market price reve...

Read Now

Moneycontrol Pro Weekender: Saint Powell and the inflation dragon

Mar 9, 2024 / 10:03 AM IST

While the markets reach all time highs, the Bank for International Settlements warns that the last mile on disinflation is a diffi...

Read Now