Punjab National Bank (PNB) has partnered with EaseMyTrip (EMT), an online travel platform, and launched a PNB EMT co-branded credit card.

According to PNB, in 2023, there was a 28 percent jump (over the previous year) in the issue of travel-related credit cards.

Adhil Shetty, CEO, Bankbazaar.com, explains that co-branded travel credit cards provide special offers on tickets, hotel bookings, etc., on the online travel sites that the bank has tied up with.

What’s on offer?

At the time of joining, PNB EMT credit card holders will receive a welcome gift voucher worth Rs 3,000, and around 300 reward points on activation.

The cardholders will be eligible for a 10 percent discount (up to Rs 1,000) on domestic flight bookings, and 10 percent off (up to Rs 5,000) on international flight bookings. It also offers a 20 percent discount (up to Rs 5,000) on domestic hotel bookings, and 20 percent off (up to Rs 10,000) on international hotel bookings, all without minimum order values.

Apart from discounts on flight and hotel bookings, it gives a flat Rs 125 off on bus bookings on a minimum booking value of Rs 500. It also offers domestic airport lounge access twice per quarter, and international airport lounge access twice per year.

Travellers who use their PNB EMT credit card should book via the EaseMyTrip website or mobile app to be eligible for the card's travel deals.

Travellers using the card on other platforms or merchant websites will not be eligible for the built-in benefits, though the annual fees will be waived if the total spend is above Rs 1 lakh.

Also read | Credit cards are useful, but an emergency fund they ain’t

What works

The cardholder gets a welcome gift voucher worth Rs 3,000 against annual fees of Rs 2,000. “It is worth noting that the PNB EMT card offers welcome benefits worth more than the joining fee,” says Ankur Mittal, Co-Founder and Chief Technology Officer, Card Insider, a platform that tracks the credit card business.

There is also a personal accidental insurance cover of Rs 2 lakh for the cardholder. If you book tickets on EaseMyTrip, you can earn multiple rewards in a variety of categories, including flights, hotels, holiday packages, etc.

Also read | Forex cards or credit cards? Which one’s a better foreign travel companion

Annual fees and interest costs

The card comes with an annual membership fee of Rs 2,000, which is waived on achieving an annual spend of Rs 1 lakh in the preceding year. The interest rate is 2.95 percent per month (i.e., 35.89 percent per annum) on revolving credit.

What doesn’t work

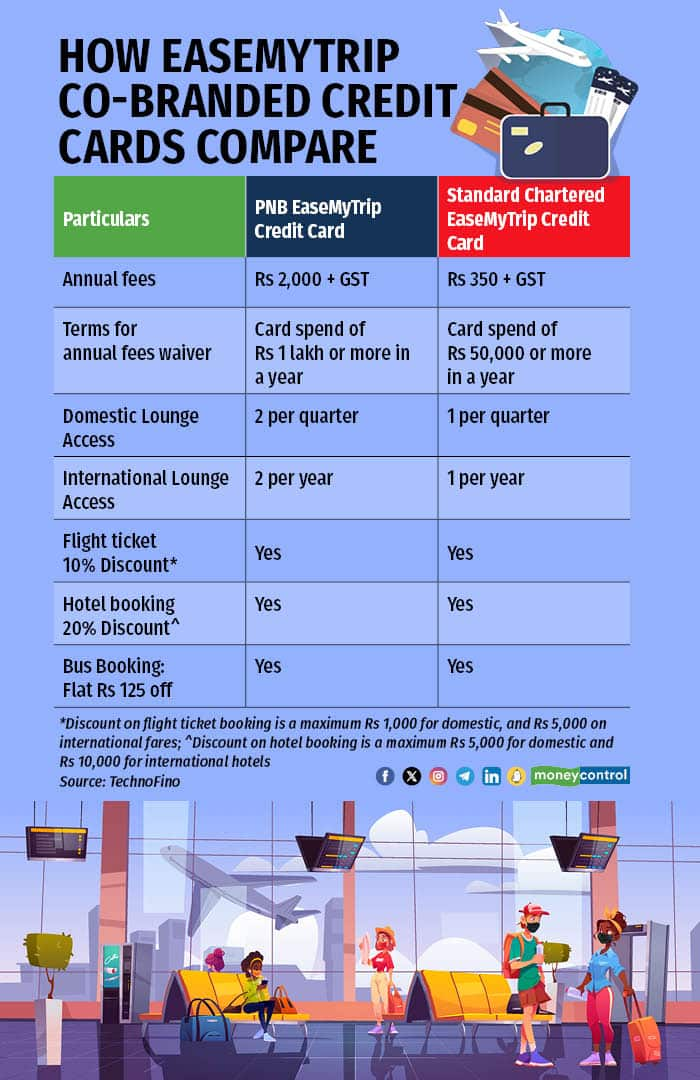

The main drawback is its annual fees. In July 2022, EaseMyTrip had launched a co-branded credit card with Standard Chartered bank at an annual fee of Rs 350.

“Comparing these cards, it can be said that the PNB EMT credit card is overpriced,” says Sumanta Mandal, Founder of TechnoFino, a platform that reviews debit and credit cards. The Standard Chartered EMT credit card is available for one-sixth of this, and cardholders get similar benefits for hotel and airline bookings (see graphic), he adds.

PNB says that the higher annual fees of the PNB EMT card is primarily because of its enhanced benefits and features.

On the Standard Chartered EMT credit card, the renewal fee is waived if you spend at least Rs 50,000 in a year. ``In the PNB EMT card, the amount is double that,” Mittal points out.

Should you apply for a PNB EMT credit card?

The card has high annual fees, which may be justified by the welcome benefits they offer, so assess whether the perks outweigh the costs before you apply. Spending Rs 1 lakh and above can lead to the annual fee being waived. Make sure this is in line with your average annual card spends. Before you apply, also look at discounts on bookings, complimentary insurance, and lounge access. Ensure that the benefits and rewards align with your travel patterns.

“This card is six times more expensive than its rival, the Standard Chartered EaseMyTrip credit card, which offers almost identical benefits,” says Mandal. So, if the cheaper option and its benefits are more in tune with your travel and annual card spend patterns, you may want to consider that.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!