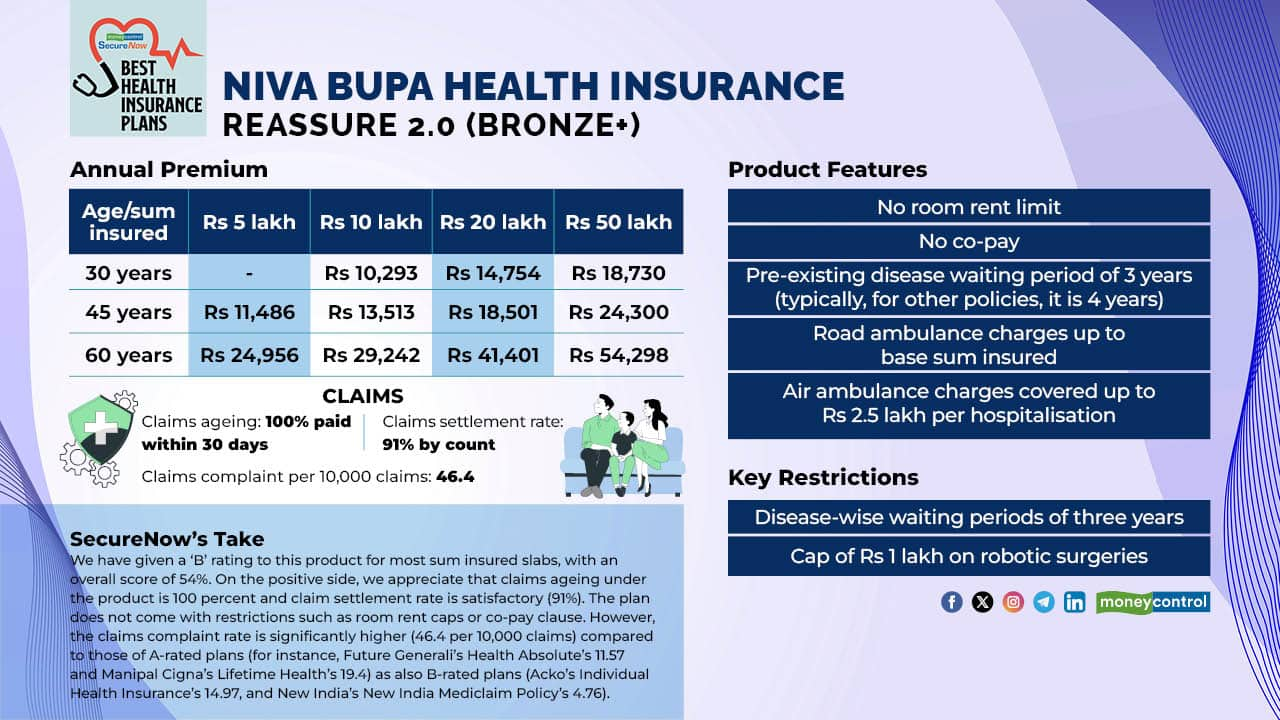

Niva Bupa Health Insurance's Reassure 2.0 (Bronze+) is a B-rated plan as per Moneycontrol-SecureNow Health Insurance Ratings, with an overall score of 54 percent.

The ratings are based on meticulous research using stringent parameters. A 'B' grade is assigned to plans with an overall score in excess of 45 percent, but less than 65 percent, which is the minimum score required to be an A-rated plan.

Good claim settlement record, but high claim complaints a concern

When it comes to claims processing, the Reassure 2.0 Health Insurance Plan boasts a claims ageing rate of 100 percent. This ensures that your claims will be handled swiftly, guaranteeing timely reimbursement of medical expenses. Additionally, the plan has a claim settlement rate of 91 percent.

Also read: How to pick the right health insurance policy

However, it's important to acknowledge the areas where this plan falls short. The claims complaint rate for this product stands at 46.4 per 10,000 complaints, significantly higher compared to other A and B-rated plans. For example, Bajaj Allianz’s Individual Health Insurance has a complaints rate of 2.9 percent, HDFC ERGO’s Optima Secure stands at 6.2, and Aditya Birla’s Active Assure Diamond is at 18 percent, making the Reassure 2.0 plan less favourable in this regard.

Moving on to the plan's features, one of its notable strengths is its comprehensive coverage with minimal restrictions. The absence of a mandatory co-pay requirement allows policyholders to access medical services without worrying about out-of-pocket expenses.

Also read: Aditya Birla Active Fit Health Insurance: benefits, eligibility, claims and more

Attractive features and benefits, but high complaints rate a dampener

Attractive features and benefits, but high complaints rate a dampener

No room rent sub-limit is a plus

The plan does not impose any limits on room rent, providing flexibility in choosing facilities according to individual preferences and needs.

Moreover, the plan offers several value-added benefits. These include an annual health check-up of up to Rs 5,000. Additionally, policyholders are entitled to a 30 percent discount on policy renewals for maintaining good health.

More expensive than other plans

Despite these strengths, it's crucial to consider certain limitations and exclusions. For instance, there's a two-year waiting period for disease-specific coverage such as pancreatitis and stones in the biliary and urinary systems, cataract, hernia of any type, ulcer, erosion or varices of the gastrointestinal tract, etc.

Disease-wise sub-limits also apply, with a maximum coverage limit of Rs 1 lakh for modern treatment procedures like robotic surgeries. The premiums are also higher compared to other A and B-rated plans.

Although Reassure 2.0 Health Insurance Plan provides extensive coverage with efficient claims processing and valuable benefits, it's crucial to carefully consider its drawbacks when comparing it to other available options.

Not making the A-grade

The plan has a higher rate of complaints compared to other options in the market. Moreover, it lacks features such as restore benefits, OPD coverage, and no disease-wise capping, which are often considered essential for comprehensive health coverage.

Given these limitations, the Reassure 2.0 Health Insurance Plan is classified as a B-rated plan rather than being among the top A-rated plans in the market.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!