As reported in Moneycontrol, Infosys Founder NR Narayana Murthy has gifted Infosys shares worth over Rs 240 crore to his four-month-old grandson Ekagrah Rohan Murty.

While all the details of this transfer of shares are not known, as with any other income, gifts are subject to tax under certain circumstances. There are situations, though, where gifts may be exempt from tax.

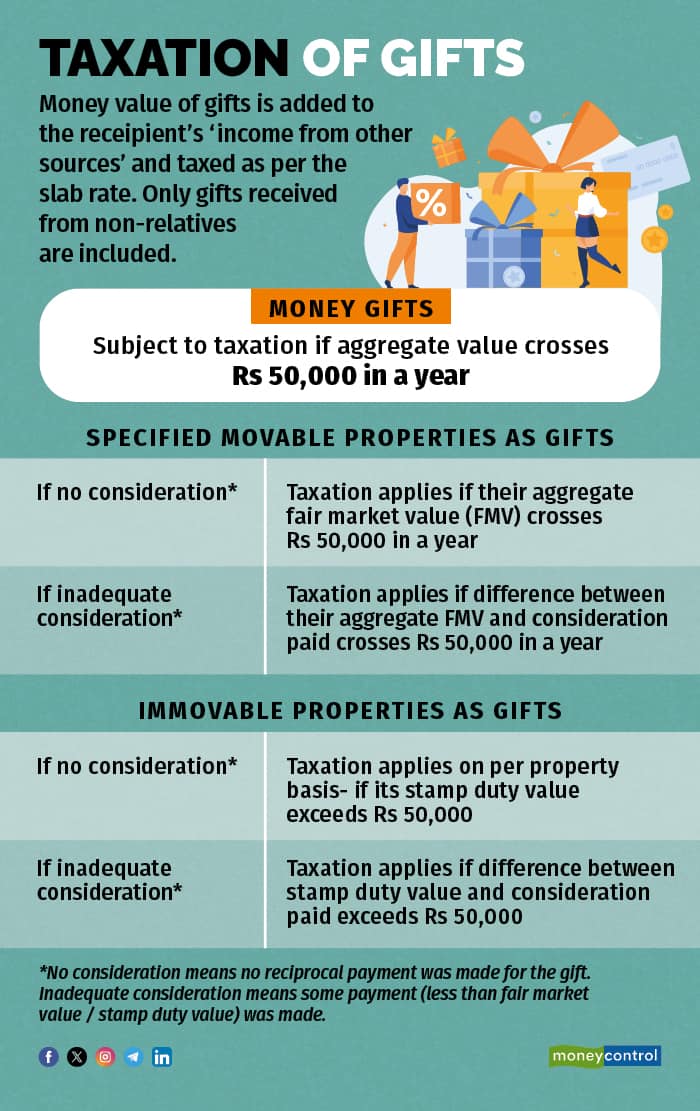

Here's how gifts are currently taxed in the recipient’s hands, under Section 56 of the Income Tax Act.

Money gifts, or immovable properties, and specified movable properties received for no / inadequate consideration from non-relatives are treated as gifts (see table). The value of these is accounted for under ‘income from other sources’ and taxed per your applicable income tax slab. If the gift is to a minor, then the parent / legal guardian is responsible for the tax.

Gifts that are taxed

Money: If you receive money gifts (in cash, via cheque, etc.), taxation kicks in only if the aggregate value of such money exceeds Rs 50,000 in a year. Below this limit, no tax applies.

So, if you receive money gifts worth Rs 75,000 during a year, then this entire amount, and not just Rs 25,000 (the amount in excess of Rs 50,000) will be taxed.

Also read: Weddings and money: Gifts of gold are not taxed, but…

Movable property: If you receive certain specified movable properties for no consideration (that is, you make no reciprocal payment for them) during a year, and their aggregate fair market value exceeds Rs 50,000, the entire amount will be subject to tax. For instance, if you receive jewellery and paintings worth Rs 20 lakh in a year, this entire amount will be taxed as it exceeds the Rs 50,000 limit.

If you receive certain specified movable properties for inadequate consideration (that is, you make some reciprocal payment for them), then the difference between the aggregate fair market value and the consideration paid for the properties will be taxed, if the differential amount exceeds Rs 50,000. For example, if you receive jewellery and paintings worth Rs 20 lakh during a year for which you pay Rs 12 lakh in total, then Rs 8 lakh will be taxable.

Note that taxation applies only in the case of specified movable properties: shares/securities, jewellery, archaeological collections, drawings, paintings, sculptures or any work of art and bullion, and virtual digital assets (such as cryptocurrencies).

Immovable property: If you receive any immovable property (land and /or building) for no consideration (no reciprocal payment is made) where the stamp duty value (property value as assessed by the government) exceeds Rs 50,000, the entire stamp duty value is subject to tax. So, if you receive a property with stamp duty value of Rs 10 lakh as a gift, this entire amount will be taxed.

If you receive any immovable property for inadequate consideration (some reciprocal payment is made), the difference between the stamp duty value and the consideration paid is taxed, if this differential amount exceeds Rs 50,000. Say, you receive a property with stamp duty value of Rs 25 lakh for which you have made a payment of Rs 10 lakh, then Rs 15 lakh will be taxed as a gift.

Note that, in case of money gifts and movable properties, the Rs 50,000 annual limit (for each of them) is applicable on the aggregate value of gifts received during the year. But in case of immovable property, the Rs 50,000 limit is applicable on each property transaction. So, if you receive multiple properties as gifts in a year such that none of the properties breach the Rs 50,000 limit, then no tax applies.

When gifts are not taxed

In all the above cases, taxation applies only when gifts have been received from non-relatives and they exceed the Rs 50,000 limit (applicable separately for money gifts, movable properties and immovable property).

Under the Income Tax Act, gifts received from relatives are not taxed, irrespective of their monetary value. But who is considered a ‘relative’? Say, there is a couple, H and W. H’s relatives comprise a) H’s spouse, b) H’s brother or sister, c) W’s brother or sister, d) H’s parents’ brothers or sisters, e) any lineal ascendant or descendent of H or W, and spouses of b), c), d) and e).

Lineal ascendants include blood relatives such as parents, grandparents and great grandparents, and lineal descendants include children, grandchildren and so on.

Gifts received on the occasion of marriage, or under a will or by way of an inheritance, too, are not subject to tax. Note that a marriage is the only occasion on which gifts received are not taxed. Gifts received on any other occasion are subject to tax.

Also read: Showered with gifts at your wedding? Here’s how they will be taxed (or not)

Apart from this, the exemption also applies in cases where any amount is received from certain funds, foundations, educational and medical institutions etc. (as specified under section 10(23C)) or from charitable trusts and institutions (as specified under section 12A, 12AA and 12AB).

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!