The Union Budget has set the tone for growth with fiscal prudence. The upcoming General Election and the new government formation should pave the way for long-term development. But while there’s no doubting the India story, the question for investors is: which are the stocks that are poised to generate alpha in these exciting times?

Our approach to this question is simple—we believe the government’s refusal to go in for populism in the Interim Budget sends a strong message, not only about its priorities, but also about its confidence in winning the general election. Furthermore, the finance minister clearly indicated in her budget speech that the next generation of reforms are round the corner. We also believe that the Indian economy and its corporate sector are poised for take-off.

Against this backdrop, our focus has been on companies which are building the future and have the best prospects of benefiting from the post-election government pushing the pedal on reforms. We are confident that the new government will have a strong focus on manufacturing, digitalisation, defence indigenisation and infrastructure, while we also think that premiumisation in consumption, the capex upcycle and green technology are trends that will get stronger.

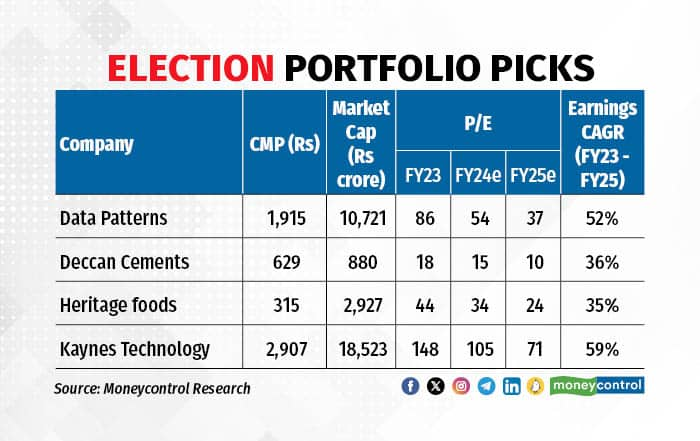

After analysing all these factors in depth, MC Pro Research has curated fourteen stocks to play this higher-level reset of the Indian economy.

Data Patterns: With a strong competitive edge in defence electronics and systems, Data Patterns is well positioned to tap growing opportunities in the defence market. Its robust execution and improving product mix are driving scale and margins. Besides, order flows remain strong and the current backlog at Rs 1000 crore, or two times annual revenue, provides good visibility.

Deccan Cements: This small cement manufacturer operating in the southern region is planning to double its capacity over the next 18-24 months. The stock remains a top draw in the cement sector due to a robust demand environment, declining power and fuel costs, prolonged underperformance, and reasonable valuations.

Heritage Foods: The company has been seeing improved performance. Lower milk procurement prices along with a higher share of higher margin value-added products should help in improving margins and profitability. Heritage is expanding its milk procurement and chilling capacities and targeting margins of 6-7 percent in the medium term from the current 4.9 percent.

Kaynes Technology: It is the only player that is generating double-digit margin in the fast-growing Indian EMS (electronic manufacturing services) industry, with a well-diversified product and client portfolio. With the upcoming OSAT (Outsourced semiconductor assembly and test) facility, the company stands to gain a large share in the electronics manufacturing supply chain that should translate into strong earnings growth for many years.

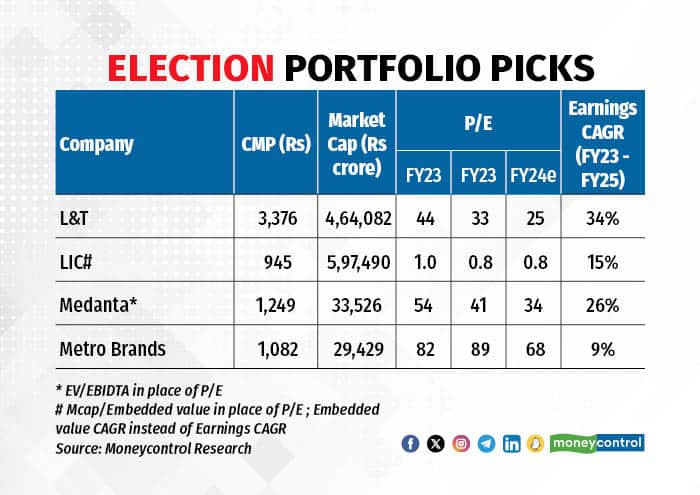

L&T: A strong capex cycle and government spending is supporting L&T, which is sitting on a huge order backlog of Rs 4.7 lakh crore (about 3.8 times FY23 revenues), providing strong growth visibility. The medium-term outlook remains reasonably good, thanks to improving margins, opportunities in the emerging sectors, revival in the service businesses and strong earnings growth.

LIC: While it holds the leading market share in the life insurance sector, its performance lags private players. The insurer’s strategy is to improve its return ratios and it is also focusing on a product mix that can enhance margins. LIC is trading at a significant valuation discount to listed private peers and its current valuation factors in most concerns.

Global Health (Medanta): Rising health insurance penetration has strengthened the demand for high-end healthcare facilities. Medanta has consistently delivered healthy margins and return ratios with faster turnaround of its new hospitals. Given its aggressive expansion plans in the Tier II towns and the government’s focus on ‘insurance for all’, Medanta is best positioned to play the healthcare growth story.

Metro Brands: With normalization of its base in the current fiscal, MBL aims to resume strong double- digit growth from FY25. Network expansion and premiumisation of the product portfolio will drive growth. Restructuring of FILA and the recent tie up with Foot Locker would enable MBL to tap high potential Sports & Athleisure footwear in India.

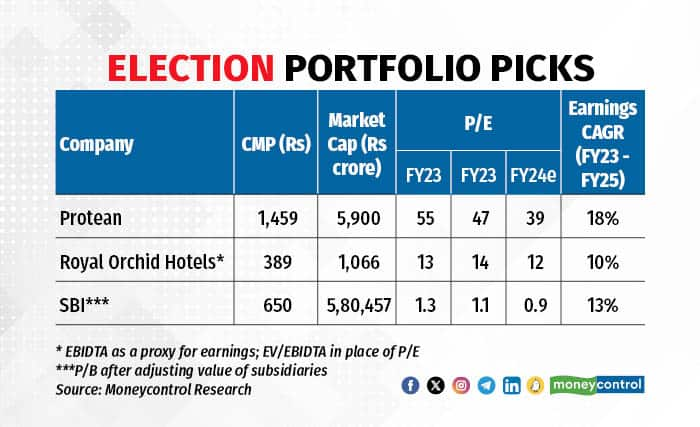

Protean eGov Technologies: Being a pioneer in e-governance solutions and building digital public infrastructure (DPI), this is a unique play on rising digital adoption in India. The company’s business model is asset-light with annuity-type revenue, it enjoys high operating leverage, and has a track record of healthy profitability and cash generation.

Royal Orchid Hotels (ROHL): Travel has been gaining wallet share of consumers, thanks to rising income and higher propensity to travel. The hotel industry upcycle is expected to be sustained, as demand will outpace supply, thus supporting pricing growth. ROHL aims to increase its room count by 50 percent over next two years and is well placed to ride the upcycle.

SBI: SBI’s performance has improved in the past few years with ROA (return on assets) of around 1 percent. The bank will benefit from rising capital expenditure and a consequent pick-up in credit demand. The bank’s investment book also stands to gain from the fall in yields. Given its leading position, improved return ratios and favourable asset quality cycle, SBI should command a better valuation.

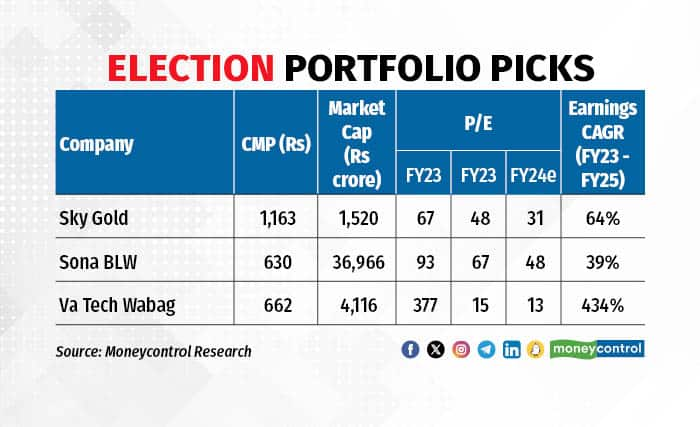

Sky Gold: SGL would be a key beneficiary of increased formalisation of the domestic jewellery industry, as it supplies to the leading organised retail jewellery chains and also aims to scale up exports. SGL is tripling production capacity and is in talks with pan-India retail players to commence supplies. Margin improvement owing to operating leverage and better product mix would aid in strong earnings growth.

Sona BLW: With leadership in Electric Vehicles (EVs) and technology know-how, Sona BLW stands to benefit significantly from the upcoming opportunities in EVs, both in India and in the international markets. This strong financial performance and high operating margin should result in an industry-leading performance.

Va Tech: The company is benefiting from the strong capex cycle in the water and water treatment space, particularly in the domestic market. It is sitting on an order book of close to Rs 12500 crore or 4 times its annual revenue. Their strategy to move up the value chain, reduction in debt, focus on margins and strong order book should support higher earnings.

For more research articles, visit our Moneycontrol Research page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Oil market heats up

Mar 20, 2024 / 02:49 PM IST

In today's edition of Moneycontrol Pro Panorama: Japan's bank rate hike and its implications, current political situation re-asser...

Read Now

Moneycontrol Pro Weekender: Saint Powell and the inflation dragon

Mar 9, 2024 / 10:03 AM IST

While the markets reach all time highs, the Bank for International Settlements warns that the last mile on disinflation is a diffi...

Read Now