March 31 is now less than a fortnight away.

In an ideal situation you would have completed your tax saving exercise by now. However, if you haven’t, the time to start the process is now. Delaying it until the last minute could result in setbacks – in the haste to meet the deadline you could end up with an unsuitable instrument or find that you are unable to complete the process due to technical glitches on investment portals.

Also read: Last-minute tax saving for FY2023-24: Do’s and don’ts for tax planning in March

Fully online processes a boon for last-minute savers

National Pension System (NPS) is an instrument that can tick several boxes at one go – a must-have retirement oriented product in everyone’s investment portfolio, facility to invest online and tax benefits. Even if you have exhausted the Rs 1.5 lakh limit under section 80C, NPS can help you maximise the tax breaks as it offers an additional deduction of Rs 50,000 under section 80CCD(1B).

However, in the haste to claim tax deductions, do not overlook the lock-in period and other restrictions in NPS. If you are likely to need the funds in the near future, you need to rethink your decision to invest merely to optimise the tax concessions on offer.

You will be able to access the corpus only at the age of vesting – once you turn 60 – though partial withdrawals are allowed after three years of opening the account. Also, you will be able to withdraw 60 percent of the amount tax-free as a lump sum, but the balance 40 percent will have to be mandatorily converted into annuities that will yield pension income for lifetime.

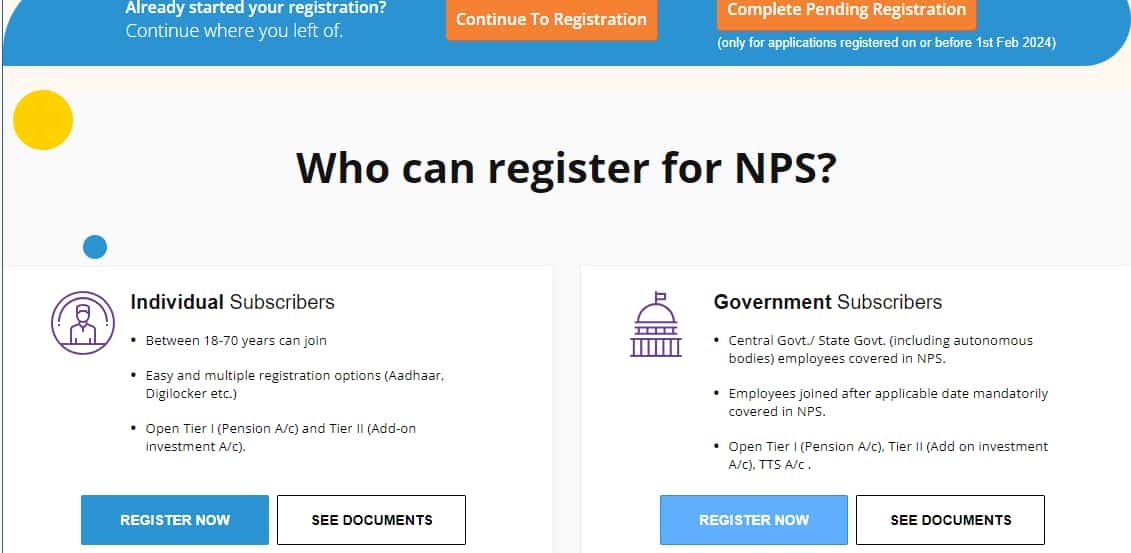

You can open an NPS account online under the All Citizens Model (voluntary, open to all Indian citizens in the age group of 18-70 years) by visiting the NPS Trust website and choosing from the three CRA (central record-keeping agency) portals. You can also open the account online through the DigiLocker facility.

Here is a step-by-step guide for resident Indians for opening a Tier-I (retirement) account through the Protean (formerly, NSDL) CRA portal. While Tier-I is mandatory, you can also open Tier-II, or investment account, voluntarily.

Step 1: Get started with documents in order

Visit the Protean portal and register yourself to open an eNPS account (https://enps.nsdl.com/eNPS/NationalPensionSystem.html > National Pension System > Registration).

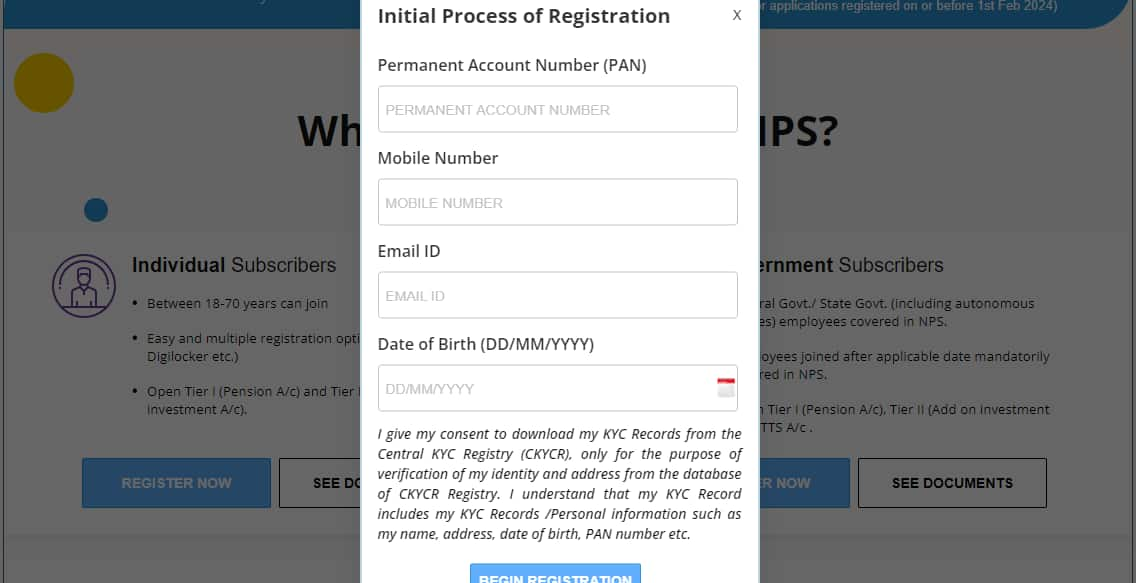

Next, click on ‘Register Now’ under the ‘Individual Subscribers’ tab. Indian citizens between the ages of 18 and 70 years can open Tier-I – the primary, mandatory retirement or pension account – as well as the Tier-II or investment account. Keep your PAN and Aadhaar numbers and a cancelled copy of your cheque handy. Other details needed include mobile number (linked to Aadhaar), email ID, an active net banking enabled bank account, scanned photograph and signature.

Also read: Changing asset allocation can give equity boost to your NPS investments

Step 2: Generate an acknowledgement number

Enter your PAN and other personal details such as mobile number, email ID and date of birth. Ensure that your mobile phone is linked to your Aadhaar, so that an OTP can be generated and proceed further to confirm your personal information. If you haven’t linked your mobile to your Aadhaar, first do so by visiting your nearest enrollment centre.

Upload a soft copy of your signature. Confirm all your details before you proceed to generate an acknowledgement number. It will also be sent to you via SMS or email. The website will then lead you to complete all the steps.

Step 3: Select your pension fund manager

Now, out of 11 pension fund managers including SBI Pension Funds, LIC Pension Fund, HDFC Pension Fund, Axis Pension Fund and so on, to manage your NPS retirement investments.

You can invest in NPS funds - scheme E (equity), scheme G (government securities), scheme C (corporate debt) and scheme A (alternative asset) in the proportion of your choice. You also have the choice of picking up to three pension fund managers to manage different asset classes.

Also, take a call on whether you want to opt for auto or active choice. The maximum allocation to equities permitted is 75 percent of your contribution under both options.

Step 4: Ensure you get the nominations right

You will have to appoint nominees, and decide the share of proceeds they will be entitled to in case of your death. Upload scanned copies of your PAN, cancelled cheque and signature to proceed to make the payment.

Also read: How to choose between auto and active choices

Step 5: Make your first contribution and generate ePRAN

You will have to make a minimum contribution of Rs 500 to the Tier-I account to start with. If you choose to receive your ePRAN (permanent retirement account number) card and welcome kit through the digital mode, that is email, you will have to pay a charge of Rs 18 – physical modes will be slightly costlier.

You can choose to authenticate all your details through esign/OTP which will be sent to your mobile and Email. Download and save your subscriber registration form, which also contains your ePRAN. You will need this number to make future NPS contributions and other transactions. You can also download and save your ePRAN card from the portal.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Mergers are not a please-all solution

Mar 19, 2024 / 02:59 PM IST

In this edition of Moneycontrol Pro Panorama: IT stocks still a favourite despite earnings cut, learn to predict market price reve...

Read Now

Moneycontrol Pro Weekender: Saint Powell and the inflation dragon

Mar 9, 2024 / 10:03 AM IST

While the markets reach all time highs, the Bank for International Settlements warns that the last mile on disinflation is a diffi...

Read Now