There are many reasons people love credit cards—they are a secure and convenient way to make payments and, alongside, help you earn reward points and other freebies, among many others.

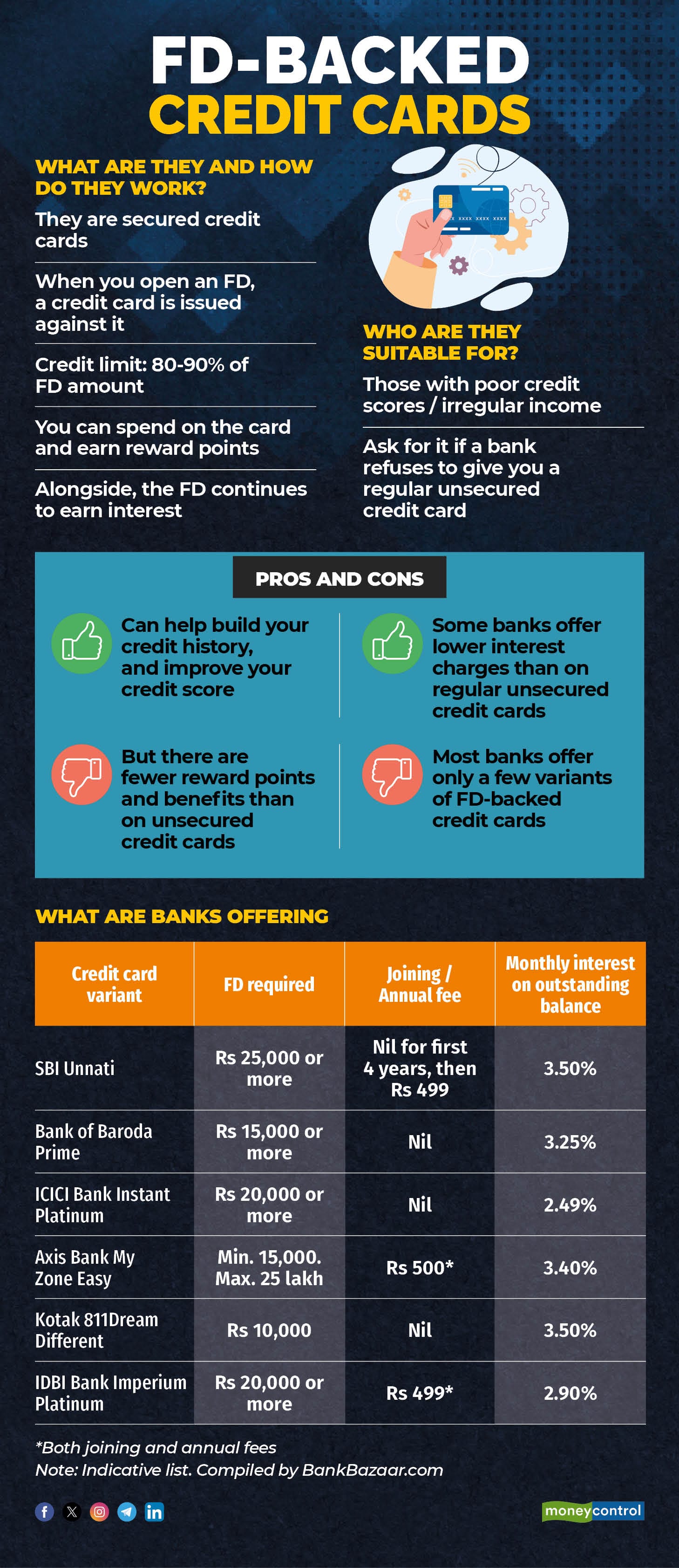

But if you have a poor credit score or have a sporadic income flow, a bank may refuse to issue you a regular credit card. That’s because when you spend on a regular credit card (unsecured credit card), you are essentially taking a collateral-free short-term loan from your bank. The bank needs to be sure that you have the financial capability to clear your credit card bills. However, a bank in such cases may instead offer a credit card that is backed by a fixed deposit (FD), taking the collateral-free condition out of the equation.

What is an FD-backed credit card?

This, as the term suggests, is essentially a secured credit card where a bank asks a customer to maintain a fixed deposit against which a credit card can be issued. This gives the bank the assurance that if a customer defaults on the card, it can rely on the FD money to clear the pending card dues.

“Generally, banks allow a period of 60-75 days beyond the due date for a customer to clear their outstanding balance. If the dues still remain unpaid, the bank can liquidate the customer's FD. In such a case, the bank will use the proceeds to cover the outstanding balance and refund any remaining amount to the customer,” said Rakshit Agarwal, co-founder, Rupicard, a digital platform offering secured credit cards.

Note that credit cards can be issued only against regular FDs and not against tax-saver FDs that enjoy Section 80C deduction under the Income-tax Act or flexi deposits that come with auto-sweep facility (where money can be swept in/swept out from your linked savings account into/from the FD).

What are the advantages of an FD-backed credit card?

If you have been denied an unsecured credit card, an FD-backed credit card can be your way out. According to Virat Diwanji, group president and head, consumer banking, Kotak Mahindra Bank, FD-backed credit cards offer the benefit of rewards and brand offers while the money invested in the FD continues to earn interest.

He said that such credit cards are suitable for someone new to credit (first-time borrower) and wishes to hold a credit card. “They also serve well customers who have a poor credit score or irregular income by helping them build their repayment history and improve their credit score,” added Diwanji.

Also, because they are backed by an FD, some banks may levy lower interest charges and annual fees for secured credit cards compared to unsecured ones.

What is the credit limit on an FD-backed credit card?

The credit limit tells you the maximum amount that you can spend on any card.

Differentiating between an unsecured and FD-backed credit card, Parijat Garg, a personal finance expert, said, “Secured credit cards will generally have a lower credit limit which will be a certain percentage of the FD amount. On the other hand, unsecured credit cards have a credit limit that is a multiple of one’s income.”

The credit limit on an unsecured credit card is generally set at 80-90 percent of the FD amount.

You can now Invest in Fixed Deposits on the Moneycontrol app

Can you get any credit card if you are willing to back it with an FD?

No. Each bank offers only select FD-backed credit cards. “These are entry-level credit cards and each bank may have only a few or perhaps even just one variant of an FD-backed credit card,” explained Garg (see graphic).

If you need money, can you break the FD backing a credit card?

Yes, but you will have to surrender the credit card and clear all payments/dues before you can access the FD money.

How do FD-backed credit cards score on card benefits?

Unsecured credit cards are entry-level cards and, hence, tend to offer fewer reward points and benefits compared to unsecured credit cards. Remember, though, they have lower interest charges and other fees.

If you care for card benefits, all is not lost. “To start with, you can take a secured credit card. If you spend carefully and make timely payments, then based on your credit card behaviour over several months, a bank may eventually upgrade you to an unsecured credit card, “said Garg.

At the end of the day, whether you have a secured or an unsecured credit card, unless you can pay off the card bills regularly, you will land up in a debt trap.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!