Budget 2024 Updates

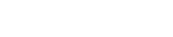

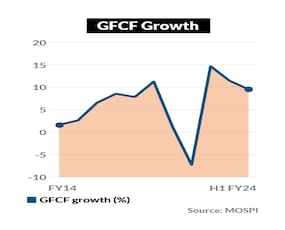

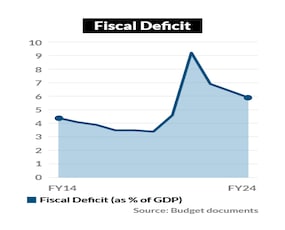

Finance Minister Nirmala Sitharaman presented an Interim Budget with fiscal prudence as the underlying theme. The FM pegged the fiscal deficit target for the upcoming financial year at 5.1 percent, a recution of 70 basis points from the current year's revised target of 5.8 percent. Tighter fiscal consolidation didn't take away from government's focus on capital expenditure as it hiked the spending on infra by 11.1%. The capex momentum will ensure that India's GDP growth is well insulated from any external shocks.

FISCAL TIGHTROPE

With the FY25 fiscal deficit target at 5.1%, the government made its intent clear that it will not deviate from the fiscal consolidation roadmap. The FM asked the rating agencies to take note that India not just met the fiscal glide path target but bettered it.

INCOME TAX

There was no relief for relief for tax payers in the interim budget presented on February 1, with finance minister Nirmala Sitharaman leaving rates and slabs unchanged under the new as well as the old tax regimes.

INFRA BOOST

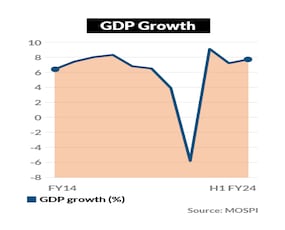

The government allocated Rs 11.1 lakh crore as capital expenditure for FY25, up 11 percent from the current year's Budget estimate. This will boost infrastructure growth and have a multiplier effect on other industries.

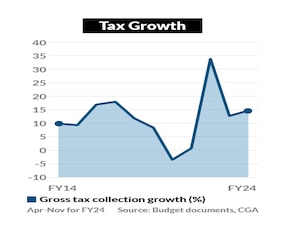

TAX COLLECTIONS

The total receipts other than borrowings and the total expenditure for FY25 are estimated at Rs 30.80 and Rs 47.66 lakh crore respectively. The tax receipts are estimated at Rs 26.02 lakh crore

RURAL HOUSING

FM Sitharaman said the government is set to roll out a comprehensive scheme targeting affordable housing for the middle class, emphasised commitment to addressing rural housing needs, and announced the extension of the Ayushman Bharat scheme to include all ASHA and Anganwadi workers.

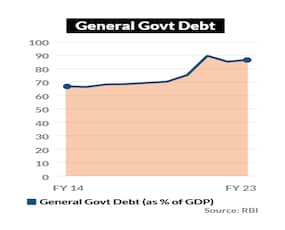

MARKET BORROWINGS

The Centre will borrow Rs 14.13 lakh crore from the markets in 2024-25 in gross terms to finance its fiscal deficit of 5.1 percent of the GDP. However, the net borrowing is only slightly lower at Rs 11.75 lakh crore compared to the revised estimate of Rs 11.80 lakh crore for the current financial year.