The Nifty 50 ended lower on March 11 on the back of broad-based selling, falling 161 points to 22,333. Nifty Smallcap 100 index fell more than the benchmark as the advance-decline ratio fell to 0.24:1 on the NSE.

The Nifty closed below its 5-DMA (day moving average). In the derivatives, Nifty Open Interest Put call ratio fell sharply as we have seen aggressive Call writing at the 22,400-22,500 levels. Moreover, triple tops have been formed around 22,500 levels during last three days suggesting that 22,400-22,500 level would be a very strong resistance on an upswing.

Traders are advised to book profit in long positions and wait for the Nifty to close above 22,500 levels for creating fresh longs.

On the downside, recent swing low of 22,269 to act as an immediate support. Any close below 22,269 would result into bearish trend reversal which could drag Nifty towards next support of 21,800-21,850 levels.

There is a negative divergence in stocks above 200 DMA against Nifty500 Index. The trend in the Nifty Smallcap Index turned bearish as it has closed below its important short-term moving averages. Therefore, we expect smallcaps to underperform Nifty in the short term.

Here are three buy calls for the next 3-4 weeks:

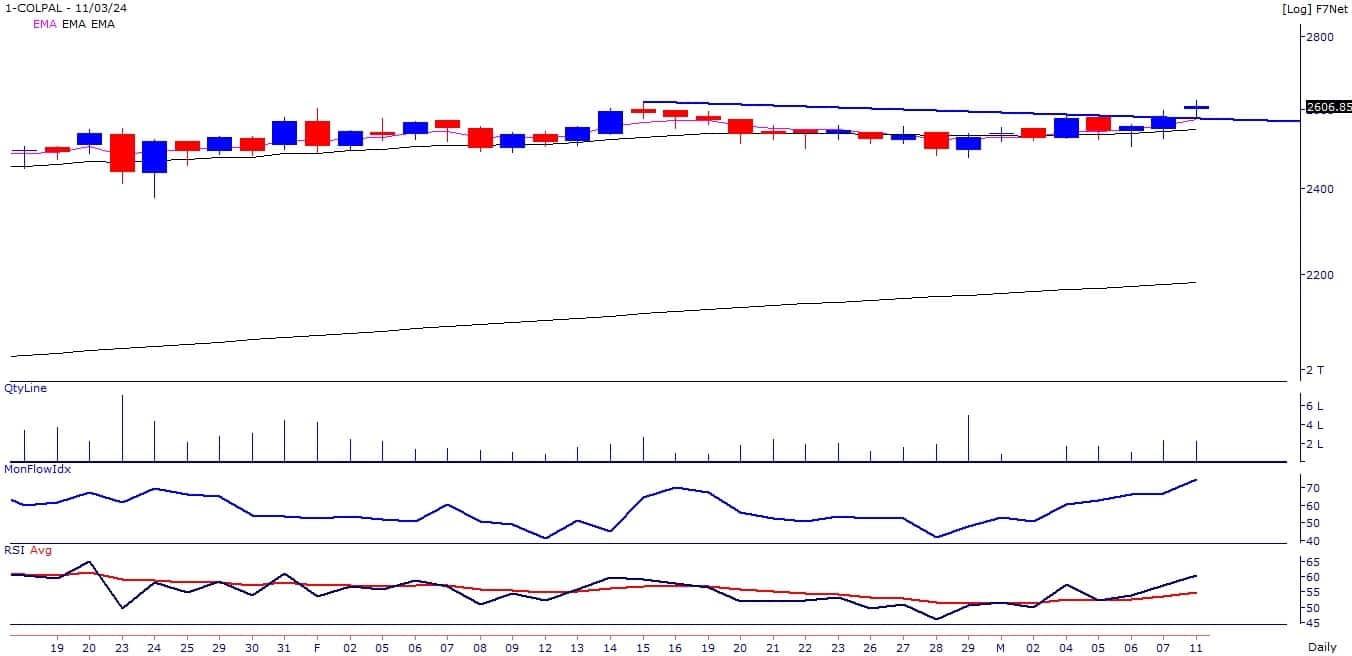

Colgate Palmolive (India): Buy | LTP: Rs 2,607 | Stop-Loss: Rs 2,480 | Target: Rs 2,770, 2,870 | Return: 10 percent

The stock price has broken out on the daily chart by surpassing the resistance of Rs 2,585 levels. Momentum indicators and oscillators like RSI (relative strength index) and MFI (money flow index) are in rising mode and placed above 60 on the daily chart, indicating strength in the stock.

FMCG stocks are expected to outperform in the coming weeks.

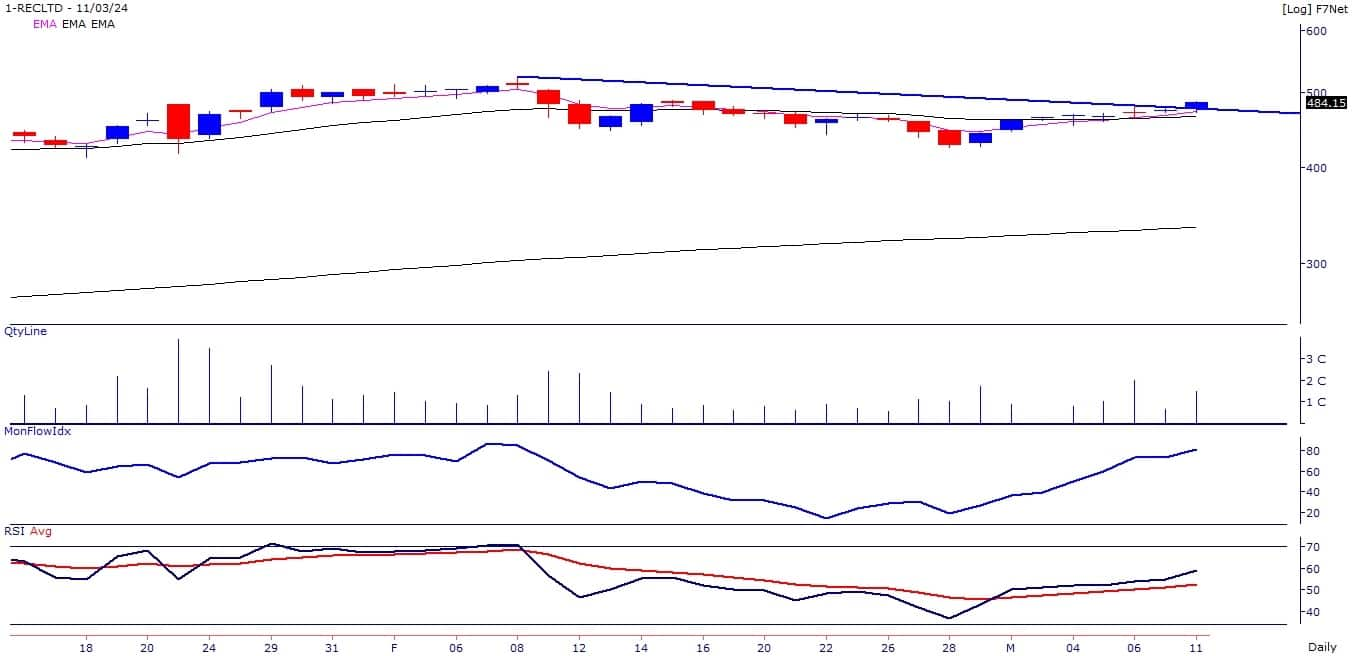

REC: Buy | LTP: Rs 484 | Stop-Loss: Rs 460 | Target: Rs 515, 540 | Return: 12 percent

The stock price has broken out on the daily chart from the downward sloping trendline, adjoining the highs of February 8, and March 6 with higher volumes.

Primary trend of the stock is positive as stock price is trading above important short and long term moving averages. Oscillators like RSI (11) and MFI (10) are sloping upwards and placed above 60 on the daily chart, indicating strength in the stock.

Tata Consultancy Services: Buy | LTP: Rs 4,122 | Stop-Loss: Rs 3,950 | Target Rs 4,330, 4,450 | Return: 8 percent

The stock price has broken out on the monthly chart by surpassing the multiple top resistance of Rs 4,000 odd levels. Stock price has been forming bullish higher top higher bottom formation on the weekly chart. Largecap IT stocks are expected to outperform in the coming days.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!