Your home loan equated monthly installments (EMI) and interest burden will remain unchanged for now, with the RBI Monetary Policy Committee (MPC) deciding to keep the repo rate steady at 6.5 percent for the sixth consecutive time.

Home loan rates are already lower compared to 2023 levels where they had started touching 9 percent. “The lowest home loan rates today are in the 8.30 percent range, with several lenders grouping around 8.50 percent for eligible borrowers,” says Adhil Shetty, CEO, BankBazaar.com.

For instance, leading banks such as the State Bank of India (SBI), Bank of Baroda, HDFC Bank and ICICI Bank currently offer home loan rates starting at 8.35-8.75 percent.

"This is a good market for new home loan borrowers who can lock in a low spread of under 2.00 over the repo rate," says Shetty.

Since October 1, 2019, banks have linked floating-rate retail loans to an external benchmark, which is the repo rate in most cases. So, any changes in the repo rate directly influence the interest rates on these loans.

Past rate hike impact on borrowers

Existing borrowers will continue to have it tough for a few more months—hopefully no more than a couple of quarters—after which one hopes that inflation would have cooled enough to warrant a repo rate cut. "Existing borrowers may be paying a higher-than-market spread, well over 2.00 over the repo rate," says Shetty.

Around 2021 and 2022, the lowest rates in the market were around the 6.50, when the repo rate was 4.00, implying a spread of 2.50 over the repo rate. "Those borrowers have the option of refinancing their loans to a lower spread and lower rate to save interest costs," Shetty adds.

For the latest on the RBI policy meet 2024, click here.

Prepay your home loan

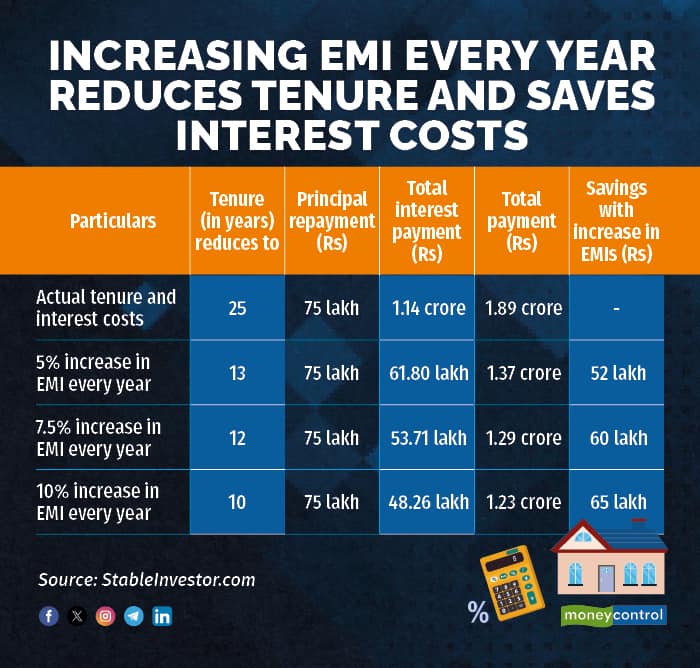

You could consider making part-prepayment of the loan out of your savings and investments. Just an extra few thousand every month can reduce your interest payout over the long term.

A good strategy is to earmark a portion of your annual bonus to prepay your housing loan every year.

Also read | Should you buy your first home now or wait for lower interest rates?

Switch the lender

There are opportunities to switch the lender in the current scenario with several banks offering home loan starting around 8.5 percent.

This is important for borrowers with government banks where a large percentage of loans continue to be on older benchmarks such as MCLR and base rate where interest rates may be marginally higher compared to the repo-benchmarked loans we have today. "Refinancing with one’s own bank is simple and low-cost but can potentially save lakhs for borrowers," says Shetty.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!