Highlights

Margins moving up gradually

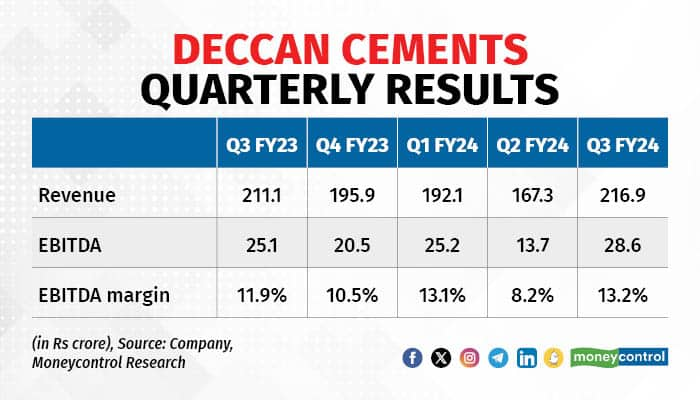

During Q3 FY24, the company clocked revenues of Rs 217 crore, up 3 percent year on year (YoY), driven by government spending in infrastructure projects. Sales for 9M FY24, however, were down 2 percent YoY.

Benign power & fuel prices and firm cement realisations aided operating margins in the Oct-Dec period. Operating margins expanded 130 basis points YoY to 13.2 percent, whereas the EBITDA (earnings before interest, tax, depreciation, and amortisation) grew 14 percent YoY to Rs 29 crore.

Looking to double capacity

Deccan operates two integrated production lines in Bhavanipuram (Telangana) having a total cement capacity of 1.8 million tonnes (MT). During Q2, Deccan received final approvals to enhance manufacturing capacity from 1.8 MT to 2.2MT. Over the next 12-18 months, the company intends to increase its cement capacity to 4MT by installing a new unit (Unit-III). The plan also includes the expansion of waste heat recovery power plant capacity from 18 MW to 33 MW. The expected investment for the expansion is pegged around Rs 600 crore, of which nearly Rs 400 crore has been invested up to Q2 FY24. The expected date for project completion is by FY25-end.

In Mar-24, Deccan Cements has incorporated a wholly owned subsidiary in the name of Deccan Swarna Cements to implement a future project in Jaisalmer, Rajasthan.

While the company has maintained strong financial discipline throughout its history with cash reserves of over Rs 250 crore (as of Sep-23), the capital structure is expected to moderate over the medium term on account of the ongoing debt-funded capex.

While the company has maintained strong financial discipline throughout its history with cash reserves of over Rs 250 crore (as of Sep-23), the capital structure is expected to moderate over the medium term on account of the ongoing debt-funded capex.

Demand environment slackening

After an encouraging performance throughout 2023, the cement sector appears to have hit a soft patch in recent months. Dealer channel surveys across regions indicate that the volume trajectory is moderating. Moreover, the fading demand environment is also triggering a correction in cement prices. While energy costs remain stable, the all-India average cement prices in Jan-24 are estimated to have declined 2-3 percent compared with the Q3 average. The demand-supply mismatch, competitive intensity, and slowdown in project execution due to the upcoming general election (May-Jun’24) are likely to impact cement realisations over the near term.

Outlook and recommendation

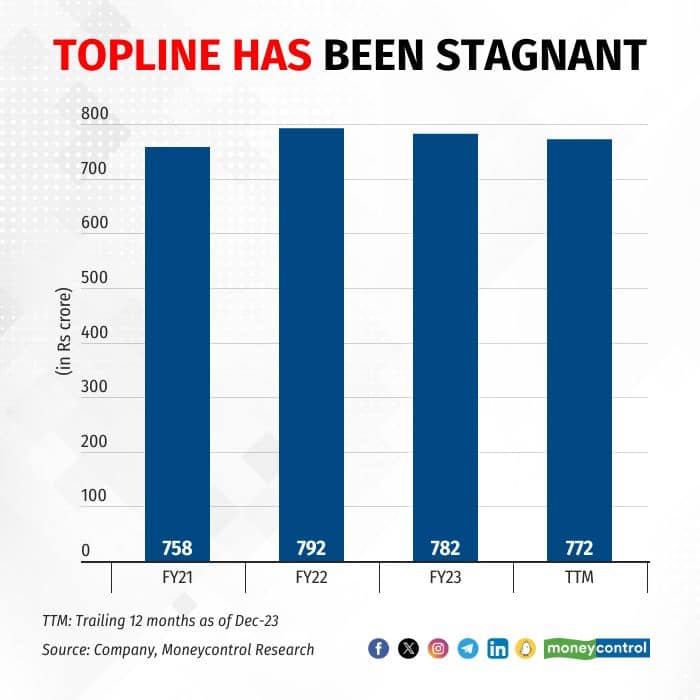

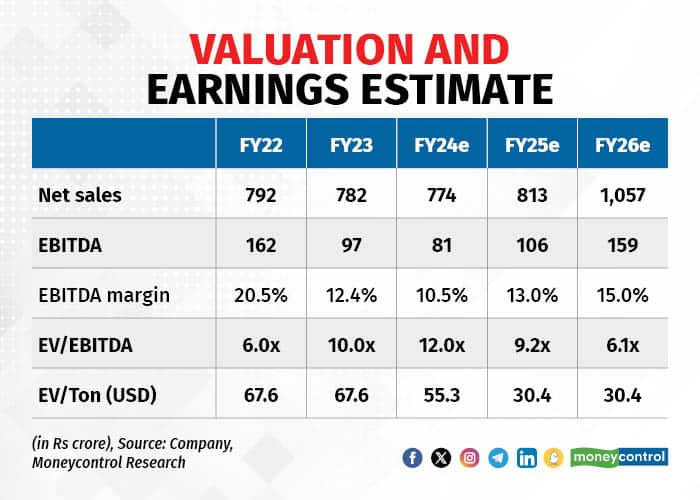

Comparing to the rest of the building materials sector, the Deccan Cements stock price has lagged by a wide margin. The underperformance could be largely attributed to the capacity constraints being faced by the business. While near-term profitability appears stable, the earnings trajectory could turn more favourable once the new plant commences commercial operations in the next 12-18 months.

The share price momentum was reasonable in the last 12 months. However, a sharp drawdown of over 15 percent in the past few weeks makes it worthy of attention. Compared to its peers, Deccan trades at a very compelling FY25 EV/ton valuation of ~30 USD.

Although the business stands to benefit from the huge growth runway in the domestic cement sector, trends in cement realisations, the change in the leverage profile, and delays in project execution are potential risks to monitor.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Mergers are not a please-all solution

Mar 19, 2024 / 02:59 PM IST

In this edition of Moneycontrol Pro Panorama: IT stocks still a favourite despite earnings cut, learn to predict market price reve...

Read Now

Moneycontrol Pro Weekender: Saint Powell and the inflation dragon

Mar 9, 2024 / 10:03 AM IST

While the markets reach all time highs, the Bank for International Settlements warns that the last mile on disinflation is a diffi...

Read Now