Highlights

Growth would continue to remain ahead of peers

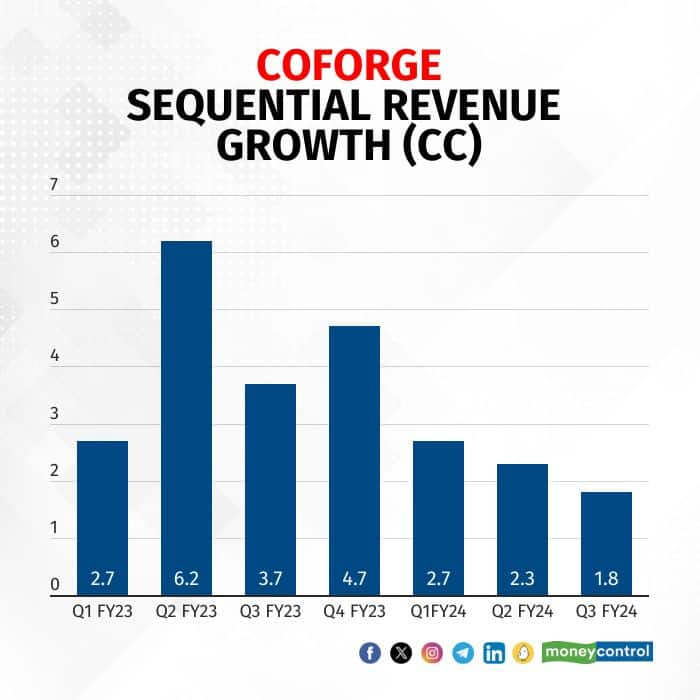

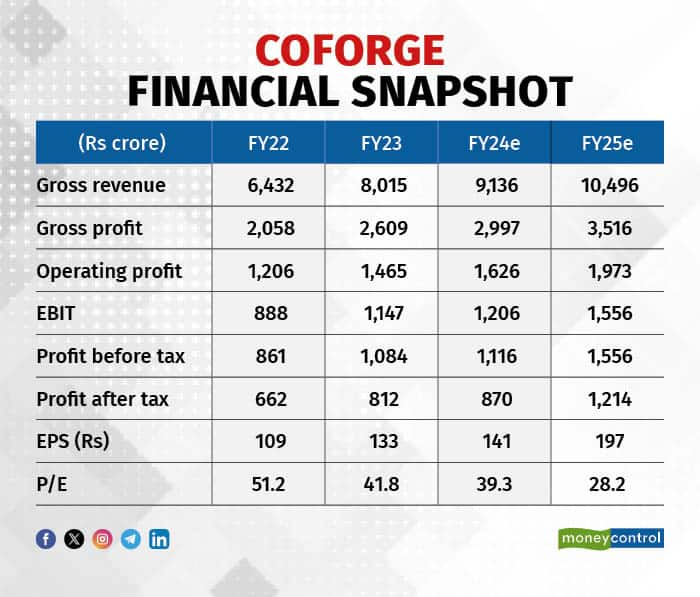

After posting over 22 percent growth in Constant Currency (CC) in FY23, the momentum sustained and, despite the impact of challenging demand and unusually high seasonal furloughs in Q3, the company clocked organic Constant Currency (CC) growth of 14.7 percent in the 9 months of FY24 with a sequential CC growth of 1.8 percent in Q3. The management is thus confident of the full-year growth to be in the guided band of 13-16 percent, with a bias towards the lower end. It expects Q4 to be a decent quarter with the reversal of furloughs.

Source: Company

Source: Company

Growth in the first nine months has been supported by banking financial services (BFS), growing by 15.5 percent, and insurance that grew 11.5 percent. However, client-specific issues marred the travel and transportation vertical that grew by 3 percent. In terms of markets, while the US has been a tad soft, strong performance came from the markets of EMEA (Europe, Middle East, Africa) and RoW (rest of the world).

Order inflows lend confidence

Despite the challenging market environment, the company continued traction in deal wins thanks to its aggressive sales and marketing efforts. In Q3, order inflows stood at $354 million, the eighth consecutive quarterly inflow in excess of $300 million. The company bagged three large deals one each in BFS, insurance, and the public sector in the UK. It added seven new clients in the quarter. However, the share of the top 5 and the top 10 clients in overall revenue declined sequentially, reflecting the impact of furloughs impacting top accounts in Q3.

Source: Company

Source: Company

The executable order book at the end of December ’23 stood at $974 million — a YoY (year on year) growth of close to 16 percent, giving a good revenue visibility for FY25.

Source: Company

Margin – multiple factors supporting margin uptick

The operating margin adjusted for the ESOP (employee stock option) rose sequentially by 200 basis points to 17.3 percent as ESOP costs normalised. The reported operating margin, however, rose by a more muted 30 basis points despite an uptick in the gross margin and lower ESOP costs due to the impact of seasonal furloughs.

The company expects a sharp uptick in margin in Q4, close to a sequential 170/180 basis points, as it is looking at a complete reversal of the impact of furloughs.

Coforge is confident of margin improvement in FY25 as well, thanks to the peaking out of sales and marketing expenses, higher offshoring, and stable resource cost as attrition has fallen to a low of 12 percent from 16 percent in the year-ago quarter. With utilisation still below 80 percent and offshore component at 52 percent, there is headroom for margin gains.

Large capital raise to support growth aspirations

In recent times, the stock of Coforge has reacted negatively to the capital-raising plans of Rs 3200 crore (9 percent of the current market cap). The company has a large gross debt to the tune of Rs 974 crore and is net cash negative. The capital infusion is expected to retire the debt and bring down the interest cost. The company will still be left with a war chest of close to Rs 2600 crore to pursue inorganic opportunities.

Coforge had indicated its intention of reaching $2 billion in revenues in the next 4-5 years where $150 million approximately would come from inorganic expansion. The proposed capital raise and M&A ties in well with this long-term goal.

While the near-term stock reaction may be dictated by the contours of the acquisition, we feel Coforge is a long-term growth leader to be added on any weakness.

Source: Company, Moneycontrol Research

Key risks: Severe demand slowdown and/or heightened competitive intensity.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Mergers are not a please-all solution

Mar 19, 2024 / 02:59 PM IST

In this edition of Moneycontrol Pro Panorama: IT stocks still a favourite despite earnings cut, learn to predict market price reve...

Read Now

Moneycontrol Pro Weekender: Saint Powell and the inflation dragon

Mar 9, 2024 / 10:03 AM IST

While the markets reach all time highs, the Bank for International Settlements warns that the last mile on disinflation is a diffi...

Read Now