Moneycontrol-SecureNow Health Insurance Ratings have categorised Aditya Birla Health Insurance’s Active Fit as an A-rated plan.

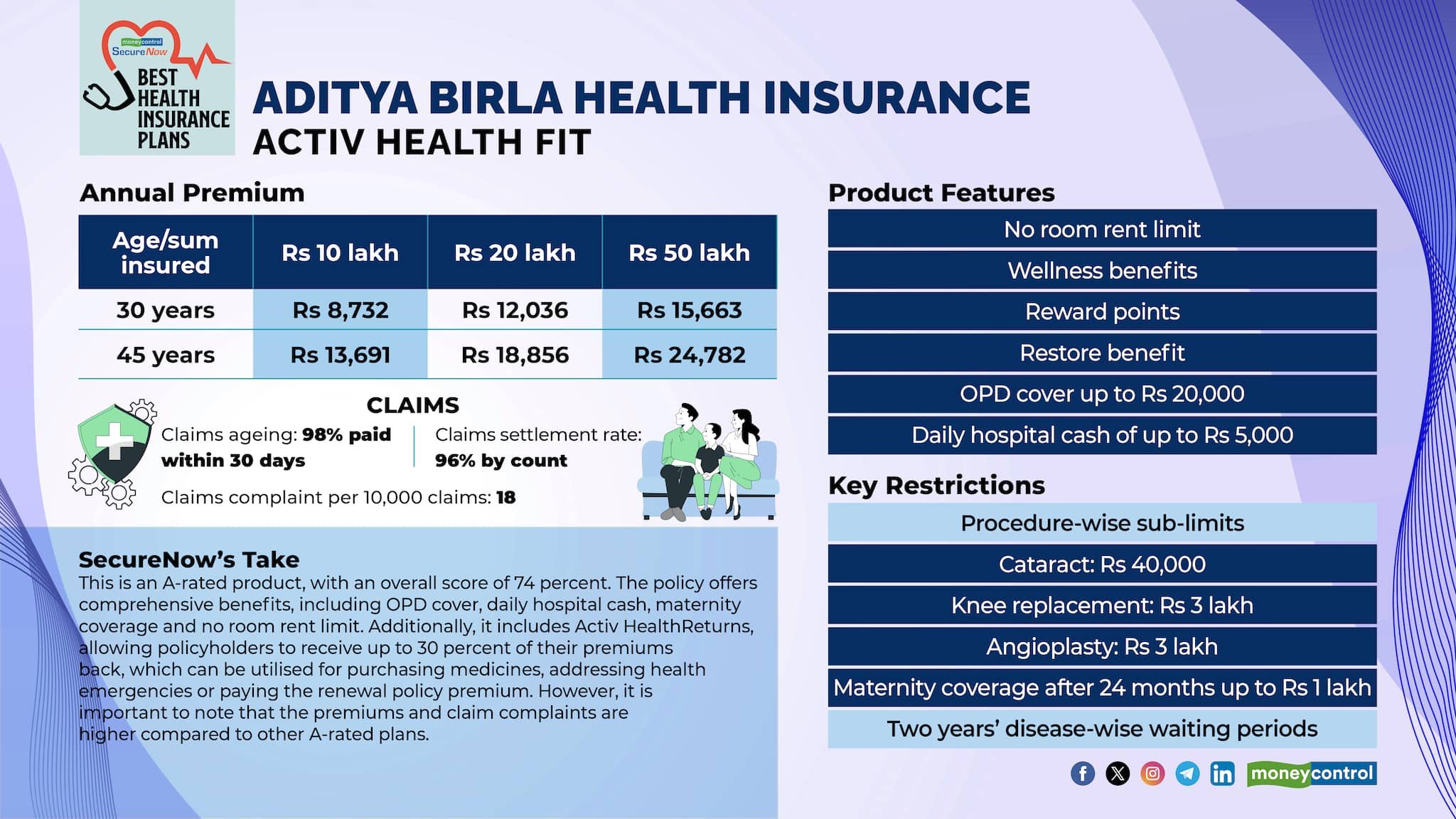

This, after reviewing its overall scores of 74 percent and 68 percent for the Rs 10 lakh and Rs 50 lakh sum insured categories respectively, within the 45-year age group. These ratings are quite selective, giving an 'A' grade only to those plans that exceed 65 percent of the overall score. This indicates that the plan not only meets, but surpasses our criteria for comprehensive coverage, benefits and overall value.

This insurance product demonstrates good claims performance, with an impressive 98 percent of claims settled within 30 days and a settlement rate of 96 percent by policy count. However, it's essential to note that the complaints rate, at 18 per 10,000 claims, is relatively higher compared to other A-rated plans.

Also read: Moneycontrol-SecureNow Health Insurance Ratings: Your guide to picking the right policy

No room rent limit and restore feature, the key benefits

As for features, the policy offers a diverse range of benefits aimed at providing comprehensive coverage. With no room rent limit, policyholders have the flexibility to choose their accommodation during hospital stays. The inclusion of wellness and restore benefits further enhances the policy's appeal, offering additional support for maintaining health and restoring the sum insured.

The policy also includes outpatient department (OPD) cover, providing coverage for outpatient expenses up to Rs 20,000. Additionally, policyholders can receive daily hospital cash of up to Rs 5,000, offering financial assistance during hospitalisation.

The limitations

However, it's crucial to consider the three-year waiting period for pre-existing diseases and the two-year waiting period for specific conditions such as cataract, sinusitis, PCOS, and others. The policy covers certain essential medical procedures with some sub-limits. For example, it offers coverage for procedures such as cataract up to Rs 40,000, knee replacement up to Rs 3 lakh, angioplasty up to Rs 3 lakh, hip replacement up to Rs 3 lakh, cholecystectomy up to Rs 60,000 and laparoscopic, open and vaginal hysterectomy up to Rs 60,000. Furthermore, the policy offers a 100 percent no-claim bonus, rewarding policyholders for maintaining a claim-free record.

Also read: Planning to have a kid? Ensure you get the right maternity insurance plan

Maternity coverage is also included in the policy, becoming available after 24 months, providing coverage up to Rs 1 lakh. While this delay in coverage may affect those planning for childbirth soon, the inclusion of maternity benefits adds to the policy's overall comprehensiveness.

In conclusion, while this A-rated insurance policy offers comprehensive benefits, potential policyholders should carefully consider waiting periods, sub-limits and maternity coverage delays. Despite these considerations, the strong claims performance and extensive coverage make it a competitive choice within its category, despite slightly higher premiums and complaints compared to other plans.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!